Der Beitrag Continuous transaction controls (CTCs) and real-time tax reporting erschien zuerst auf ecosio.

]]>- CTCs require invoice data to be shared with tax authorities in real time, shifting compliance from post-audit to live validation

- More countries are adopting CTCs, including for B2C, making technical readiness essential for businesses operating internationally

- Common challenges include system integration, workflow changes, and data security, often requiring cross-department alignment

- CTCs can improve efficiency and audit readiness, especially when supported by scalable solutions and expert guidance

As tax authorities begin to embrace digital tools, the way businesses meet their tax obligations is undergoing a fundamental shift. At the centre of this change is the rise of continuous transaction controls (CTCs).

In this article, we break down what CTCs are, the challenges and benefits they present, and what businesses can do to stay ahead of the curve.

What are CTCs?

Continuous transaction controls (CTCs) are real-time or near-real-time government-imposed mechanisms designed to monitor and regulate business transactions, particularly for VAT compliance. Unlike traditional post-audit models where invoices are reviewed after being issued, CTCs require transactional data, such as e-invoices, to be submitted to or cleared by tax authorities before or during the exchange between buyer and seller.

Why are CTCs growing in popularity?

CTCs are growing in popularity because they allow governments to combat VAT fraud and boost revenue by gaining real-time visibility into business transactions. Traditional tax reporting methods often leave long gaps between invoice issuance and audit, making fraud easier to commit and harder to detect. With continuous transaction controls, tax authorities can validate, approve, or receive transactional data almost instantly, tightening compliance and reducing errors. As digital infrastructure improves and tax gaps remain a priority across regions, more countries are adopting CTC models to modernise their tax systems and ensure better control over domestic and cross-border trade.

How do CTCs work?

Continuous transaction controls (CTCs) change how invoices are processed by requiring businesses to share invoice data with tax authorities in real time, often before sending the invoice to the customer. This contrasts with traditional invoicing, where reporting happens later and in bulk.

Here’s how the CTC process typically works from a technical perspective:

- Invoice creation: A structured e-invoice (in a machine-readable format such as XML or UBL) is generated within the business’s ERP or invoicing system

- Data transmission: The invoice data is sent electronically (often via an API) to a government portal or central tax platform

- Validation by authorities: The tax authority automatically checks the invoice for required fields, accuracy, and compliance with local tax rules

- Clearance or acknowledgment: If the invoice passes validation, the authority either clears it for dispatch or provides a confirmation receipt

- Invoice delivery: The validated invoice is then sent to the buyer, often with an official code or reference attached

This automated process increases transparency and control for tax authorities, while requiring businesses to adopt compliant technical infrastructure.

Why companies can’t ignore CTCs

It’s the law!

More and more countries are implementing CTCs on a mandatory basis. Italy, for example, has been using CTCs across the board since 2019. Meanwhile, France, Poland and Spain are following suit with a staggered introduction.

CTCs are expanding to include B2C transactions too

While the first mandatory CTCs focussed on B2B transactions, the B2C sector is increasingly taking centre stage. Countries such as Romania, Malaysia and Saudi Arabia already require the reporting of B2C transactions, and France will soon too.

Common CTC challenges

Adopting continuous transaction controls (CTCs) can require significant technical and organisational change, with businesses often facing the following hurdles:

- Technical integration: Connecting to government platforms typically involves API-based communication and generating structured e-invoices, which many legacy systems aren’t equipped for.

- Data protection and security: Sensitive invoice data must be transmitted externally, often in real time. Internal teams must ensure systems and processes comply with GDPR and local security laws, without exposing the business to data breaches or non-compliance.

- Process adjustments: In many CTC models, invoices must be validated by authorities before reaching the customer. This demands new workflows, timing, and automation.

- Employee training: Teams across finance, IT, and compliance must understand and implement the new requirements accurately to avoid errors or delays.

Successfully addressing these challenges often involves cross-department collaboration and, in many cases, external support or specialised tools.

How can CTCs benefit companies?

While CTCs are typically seen as a headache by companies due to the effort involved in preparing for them, they do benefit businesses in several ways, including…

- Efficiency gains through expansion of automated processes

- Reduced manual effort relating to tax reporting

- Improved transparency for accounting and auditing

- Fewer queries from authorities

- Faster tax processing

How should you prepare for CTCs?

Being able to comply with CTCs requires strategic preparation – not only technically, but also organisationally. To ensure your business is ready, be sure to follow these steps and ask yourself the accompanying questions:

1. Analyse the status quo

Start by mapping your current invoicing processes and tools to understand your baseline. This helps reveal what already works and what needs updating.

Questions to ask include:

- Which systems are in use (ERP, accounting, archiving)?

- Are invoicing workflows already digital or partly automated?

- Do your current tools support e-invoicing formats?

- What level of integration already exists between systems?

2. Identify technical and personnel gaps

Once your baseline is clear, assess where capability gaps exist, both technical and human.

Questions to ask include:

- Can your system create structured invoices (e.g. XRechnung, ZUGFeRD)?

- Do you support required formats and transmission protocols?

- Does your team have sufficient understanding of API integrations and validation flows?

- Would it be beneficial for representatives from IT, finance, or purchasing to have more involvement moving forward?

3. Consider future requirements

Preparing for CTCs means looking beyond immediate needs. Future mandates may vary by country, customer type, and industry, so maintaining flexibility is key.

Questions to ask include:

- Are CTCs likely to affect any countries in which you operate in the near future?

- What mandatory data is required for compliance?

- How can you prepare this data in your ERP system?

- Which transactions are affected (B2B, B2G, B2C)?

- Do certain customers or industries have extra requirements?

4. Decide whether you want to build or buy

If you have limited internal resources or expect your needs to change in the future, an external solution provider can make life a lot easier.

Questions to ask include:

- Do you have the capacity and expertise to handle CTC compliance in-house?

- Have you fully investigated what external CTC-ready solutions and integrations are available?

- Will your chosen solution scale across markets and evolving rules?

Still have questions?

If you want to know more about continuous transaction controls and what you need to do to achieve compliance with various country-specific regulations, get in touch! Our e-invoicing experts will be more than happy to advise you.

Der Beitrag Continuous transaction controls (CTCs) and real-time tax reporting erschien zuerst auf ecosio.

]]>Der Beitrag Germany Commits to Making B2B E-invoicing Mandatory erschien zuerst auf ecosio.

]]>This progressive move toward e-invoicing not only demonstrates Germany’s commitment to leveraging technology for economic rejuvenation, but also positions German businesses at the forefront of digital financial practices.

What does the Growth Opportunities Act aim to achieve?

The act aims to provide tax relief measures to facilitate growth in an economy that has struggled in recent times, with Gross Domestic Product (GDP) having fallen by 0.3% in 2023. In short, by passing this act, the German government hopes to make the country’s economic landscape more efficient, transparent and resilient moving forward.

What changes will the Growth Opportunities Act bring?

A pivotal component of the Growth Opportunities Act is the introduction of a new e-invoicing mandate for domestic business-to-business (B2B) transactions. This development represents a drive to streamline financial operations and reduce the administrative overhead associated with traditional paper invoicing processes. Although debates within the Bundesrat in November 2023 suggested a potential postponement, which would have extended the timeline for adopting electronic invoicing until 2027 for receivers, the initial schedule set forth by the German Ministry of Finance (BMF) will proceed as planned.

What is the timeline?

The timeline for the phased implementation of the e-invoicing mandate is as follows:

- 1 January 2025: All German businesses must be able to receive and process electronic invoices

- 1 January 2027: German businesses with an annual turnover exceeding €800k must issue their invoices electronically for domestic B2B transactions

- 1 January 2028: All German businesses must issue invoices electronically for domestic B2B transactions

What are the technical requirements?

To ensure a seamless transition, electronic invoices must adhere to the EN 16931 standard. However, businesses retain the capacity to negotiate the Electronic Data Interchange (EDI) standards used, provided mutual agreement is reached between invoice issuers and recipients.

Whilst Germany will eventually need to comply with the digital reporting requirement (DRR), as outlined in the European Commission’s VAT in the Digital Age (VIDA) proposal, the mandate is specific to invoice exchange between supplier and buyer and does not include a Continuous Transaction Controls (CTC) / centralised model.

How ecosio can help

For organisations preparing to navigate this change, understanding the specifics of the mandate and beginning the transition early can significantly mitigate the challenges associated with adopting new technological frameworks. Thankfully ecosio’s e-invoicing experts are able to support you as Germany embarks on this journey toward digitalisation.

ecosio.invoicing makes meeting country-specific regulations easy. Our state-of-the-art Integration Hub acts as a single gateway to connect your business to customers, tax administrations and other government platforms all over the world; enhancing automation, driving down costs and helping you to achieve compliance.

Find out more

For more information on ecosio’s unique EDI solution, please contact us at edi@ecosio.com or talk to our Sales team.

Der Beitrag Germany Commits to Making B2B E-invoicing Mandatory erschien zuerst auf ecosio.

]]>Der Beitrag Seven Things to Consider When Selecting a Peppol Access Point erschien zuerst auf ecosio.

]]>- When selecting a Peppol Access Point, carefully consider implementation and support, including whether your team can set up and maintain the required infrastructure, manage security updates, and handle software patches efficiently

- Evaluate operational reliability, ensuring your AS4 server can run continuously 24/7 to meet Peppol’s availability requirements and avoid communication failures

- Think about scalability and flexibility, deciding if you need to support only Peppol or also other messaging protocols such as email, EDIFACT, or AS2 for broader integration needs

- Review service provider capabilities, including compliance with Peppol rules, certification status, pricing models, customer support quality, and ease of onboarding for your suppliers

Any business wishing to exchange messages via Peppol needs to do so via a Peppol Access Point. For businesses in this position there are two options, a) become a Peppol Access Point, or b) use a Peppol Access Point as a service (offered by a service provider).

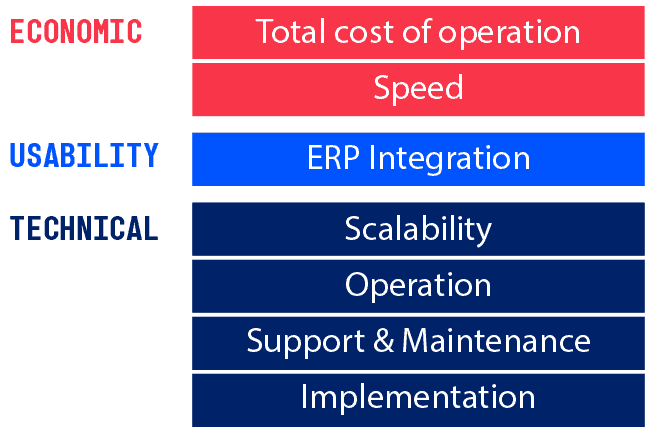

Before looking at exactly what connecting to Peppol via both of these routes entails, however, it’s important to examine the implications of this decision from a technical, economic and usability perspective.

Accordingly, we’ve compiled seven key points all decision makers should consider before selecting their preferred Access Point strategy:

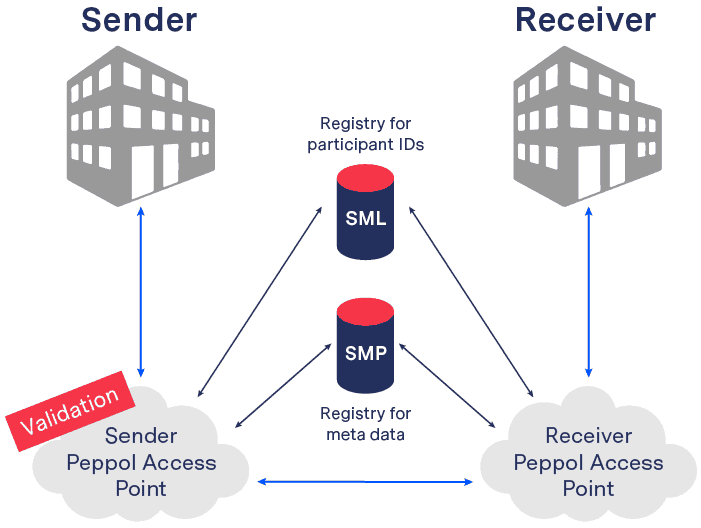

- Implementation. Is your inhouse team capable of setting up the necessary Peppol infrastructure? In other words do you have the technical expertise (in regard to software engineering) and the technical expertise of Peppol per se. You will not only need to set up a Peppol AP, but usually also an SMP (because you will want to register your production Peppol IDs as well as our test Peppol IDs).

- Support & Maintenance. The entire infrastructure not only needs to be operated, but also maintained. That means implementing security updates, software patches and new software versions – e.g. of Open Source libraries, which have been used as part of the implementation.

- Operation. Can the Peppol infrastructure be operated on a 24/7 basis according to Peppol’s service level agreements (SLAs)? Peppol expects its Access Point members to fulfill certain service level requirements. In particular, your AS4 server should always be up and running, to ensure your business partners are not in a position where they can’t reach you.

- Scalability. Do you want to focus on Peppol only, or do you want to support other concepts as well – e.g. sending invoices by email or sending invoices in EDIFACT form via AS2 etc.?

- ERP Integration. How deeply the Peppol Access Point is integrated in your ERP system will make a significant difference – in particular in regard to the visibility of sent and received documents. For more information on connecting to Peppol via an API, please see our article “Connecting to Peppol via API – What are the Benefits?”.

- Speed. How fast do you need the Peppol Access Point to be up and running? If speed is an issue, deciding to become a Peppol Access Point yourself may not be wise, as the approval process with OpenPEPPOL takes time.

- Total Cost of Operation. Remember to factor in all necessary costs, including both Capex AND Opex. Operational costs in particular are often missed – e.g. maintenance, message monitoring, and redundancy costs etc. If you become a Peppol AP yourself, OpenPEPPOL membership is also mandatory.

With these points in mind, let’s look now at what the process of connecting to Peppol via the two available methods actually looks like. Essentially the choice is similar to that between making a soup completely yourself and ordering one from a restaurant (i.e. service provider) – one involves much more time and effort than the other…

Becoming a Peppol Access Point

Becoming a Peppol Access Point yourself involves ten steps:

- Become a member of OpenPEPPOL (see their website’s “How to Join” section).

- Choose your preferred Peppol Authority (usually your national Peppol Authority makes most sense) and request the relevant Transport Infrastructure Agreement (TIA) package. See the list of Peppol Authorities.

- Sign the agreement and annexes and send it back to your Peppol Authority with a copy of your company registration document.

- Apply for an Access Point certificate via Peppol’s Service Desk. These are also known as Public Key Infrastructure (PKI) certificates and contain the key information for validating all communications on the Peppol network.

- Make sure you are able to comply with Peppol’s Business Interoperability Specifications (BIS). In line with the TIAs, at least one of the default Peppol BIS processes must be implemented.

- Ensure that you read and understand the eDelivery Network specifications. In particular…a) The Policy for Use of Identifiers (which explains how parties are identified in Peppol)

b) The Service Metadata Publisher (SMP) specification (which explains the role of the SMP and Service Metadata Locator, or SML)Also become familiar with the official Peppol AS4 profile and the official Peppol Envelope specification (SBDH). - Implement your Access Point. There are two ways to do this: a) using open source software, or b) building your own implementation from scratch.

- Follow OpenPEPPOL’s acceptance test procedure. More information on this can be found in the document “OpenPEPPOL Test and Onboarding”.

- Once notified by your Peppol Authority, request a production certificate through Peppol’s Service Desk.

- Download your certificate – you are now an official Peppol Access Point!

For more information on what exactly is involved in completing each of these steps, please see in the document “OpenPEPPOL Test and Onboarding”.

Connecting to an existing Access Point Provider

In contrast to becoming an Access Point yourself, gaining access to Peppol by connecting to an existing Access Point provider is simple.

All you have to do is select your chosen provider (see the full list of certified Peppol service providers). They will set up a connection to your system, after which you will be ready to start exchanging structured messages with other Peppol-connected companies.

It is worth bearing in mind when selecting a Peppol Access Point, however that they are not all born equal, however. Unlike ecosio, not all providers offer a fully managed service or an API connection. As a result, message exchange via some providers will take much more effort than with others.

Find out more

At ecosio we are experts when it comes to Peppol. In addition to being one of the very first Peppol access points in Europe, we have also successfully passed both Peppol AS4 testing and European Commission AS4 interoperability testing.

Thanks to our unique API, a connection to Peppol via ecosio enables you to experience unparalleled data visibility. Meanwhile, our full service offering means we not only handle setup of all connections, but also the ongoing operation of your system. This means more streamlined e-invoicing, lower costs and less stress!

Contact us to find out more about how our Peppol solution could benefit your business. We are always happy to answer any questions!

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.

Der Beitrag Seven Things to Consider When Selecting a Peppol Access Point erschien zuerst auf ecosio.

]]>Der Beitrag E-invoicing in Norway – What Do I Need to Know? erschien zuerst auf ecosio.

]]>In this article we look at the current state of e-invoicing in Norway and what you need to do to ensure you are able to exchange automated electronic invoices with Norwegian partners.

But before we start examining the current state, let’s have a brief look into the past and the e-invoicing developments in Norway.

The growth of e-invoicing in Norway

2011

Since 2011 central Norwegian bodies have been required to be able to receive e-invoices from suppliers.

2012

In 2012 it became mandatory for partners of central Norwegian bodies to send only structured electronic invoices. By passing this legislation in 2012 Norway cemented itself as one of the most forward-thinking countries in Europe with regards to e-invoicing. Indeed, this legislation was passed two years prior to Directive 2014/55/EU, which in turn didn’t require countries to implement similar regulations until April of 2018.

2019

On 1 April 2019 regulation FOR-2019-04-01-444 relating to electronic invoicing in public procurement was passed. This made it mandatory for non-central Norwegian public bodies to be able to receive and process e-invoices. Since this date suppliers of non-central public bodies have also been required to send only structured electronic invoices. Further, those e-invoices sent must conform to the EU Norm, using either EHF or the Peppol BIS standard (in addition to being sent via the Peppol eDelivery network). Similarly, all central government bodies issuing invoices themselves must also ensure their invoices conform to these standards.

2020

There is now a monitoring system in place to track the use of e-invoicing with central and non-central public bodies. Currently around 90% of all invoices sent to Norwegian public entities are e-invoices.

E-invoicing standards in Norway

Norway has implemented the European e-invoicing standard EN 16931, which has been reconciled with the pre-existing Norwegian E2B standard.

EHF (Elektronisk Handelsformat) and Peppol BIS (Business Interoperability Specification) are the two document formats that Norwegian public bodies must be able to receive. Both are based on UBL (Universal Business Language). In order to receive Peppol BIS messages all that is required is a connection to a Peppol access point provider. To accept EHF invoices receivers must be registered with ELMA (Elektronisk mottakaradresseregister).

EHF is used exclusively between Norwegian organisations. Meanwhile the more popular Peppol BIS format is used for both cross-border and national transactions, with CEF Digital estimating that the Peppol format is currently used by approximately 99% of contracting authorities.

How to send e-invoices in Norway

Thankfully, compared to other European countries, many of which have complicated e-invoicing regulations due to complex federated legal landscapes, sending e-invoices in Norway is fairly simple.

Helpfully, as already mentioned, Norwegian eProcurement relies heavily on Peppol and is dependent on both the Peppol BIS 3.0 standard and the Peppol eDelivery Network – particularly for cross-border transactions. As a result, those looking to achieve compliance with Norwegian regulations simply need a connection to a Peppol access point provider (such as ecosio). Due to Peppol’s four corner delivery model (pictured below) suppliers do not need to establish point-to-point connections to partners or use the same provider as prospective partners. Rather, all transactions can be handled through a single provider. Meanwhile, the fact that all Peppol connected companies have to use the same standards helps to drastically reduce the work (and time) required to establish new partner connections.

To help businesses understand the technical requirements, the Norwegian Digitalisation Agency has created a reference directory for IT standards in the public sector (“Referansekatalogen for IT-standarder i offentlig sektor”) which can be found on the Digdir website.

Norwegian e-invoicing requirements at a glance

| STANDARDS | IS E-INVOICING MANDATORY? | METHODS OF SENDING |

|---|---|---|

|

Suppliers of central bodies: YesSuppliers of non-central bodies: Yes |

|

What is the future of e-invoicing and EDI in Norway?

As elsewhere across Europe, the relatively recent requirement for suppliers of public Norwegian bodies to be able to send e-invoices is likely to have knock-on effects on B2B supply chains too. As more and more businesses gain the ability to send structured electronic invoices, it is highly likely that many will want to benefit from automated message exchange with all of their partners and across an increasing number of business processes. In turn, as more companies gain EDI (electronic data interchange) capability in order to achieve the associated cost savings, such capability is likely to become an increasingly essential cog in successful supply chains.

Want more information on e-invoicing in Norway?

At ecosio we are experts in e-invoicing and electronic data interchange. Over the years we have helped thousands of businesses to streamline their supply chain and improve key processes, all while minimising pressure on internal teams.

For more information on how we can help you meet e-invoicing regulations in Norway and for advice on what practical steps you can take towards automation please contact us today. We are always happy to answer any questions.

You may also be interested in our blog articles on e-invoicing in…

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.

Der Beitrag E-invoicing in Norway – What Do I Need to Know? erschien zuerst auf ecosio.

]]>Der Beitrag How is E-invoicing in Finland Different to Elsewhere? erschien zuerst auf ecosio.

]]>This article aims to shed light on the current state of play and what is needed for companies to comply with Finnish e-invoicing regulations.

The growth of e-invoicing in Finland

Finland has long been ahead of the curve when it comes to e-invoicing. This is particularly true of B2B e-invoicing – an area for which many EU countries have yet to create regulations. Regarding B2G e-invoicing in Finland, the figures are impressive too, with structured electronic invoices constituting over 92% of all invoices received by the central government (up from 64% at the beginning of 2012).

These numbers are largely a result of the fact that Finland has long understood the cost savings possible through increased automation. Following the 2014 EU directive, in 2015 a Finnish working group published a paper in which relevant bodies estimated possible savings to be €2.8 billion in invoicing between companies, €150 million for the local government sector and €150 million for the central government sector.

Although Finnish public bodies have accepted e-invoices from suppliers since 2010, until recently, there was no legal obligation for Finnish public entities to receive and process a particular type of e-invoice. This changed in February of 2019, when Finland’s parliament passed a law requiring public bodies to accept only electronic invoices whose data content corresponds to the semantic data model of the European Norm (EN). This legislation ensured Finland met the requirements of Directive 2014/55/EU. The deadlines for compliance were set as 1 April 2019 for central government bodies and 1 April 2020 for other public procurement entities.

1 April 2020 was also to be the date that the Finnish e-Invoicing Act 241/2019 came into effect. This law would have included the following two key extensions to the EU directive:

- E-invoicing compliance will be required for all invoices meeting national invoice thresholds, rather than higher EU thresholds (this approach has also been adopted by other countries such as Germany);

- Finnish public bodies as well as private entities with a turnover above €10,000 will be able to request and receive e-invoices conforming to the EN from another contracting entity or trader if desired. This would mean that organisations can reject e-invoices that do not comply with EN guidelines.

An unexpected delay

Unfortunately, due to Covid-19 and the knock-on effects on business and day-to-day life, the Finnish treasury released a statement on 18 March 2020 in which they revoked the 1 April deadline. As such, until further notice, non-central Finnish public entities and Finnish companies with turnover of over €10,000 are not required to be able to send and receive invoices meeting EU e-invoice standards and can still exchange older formats.

Despite this development, it is advised that Finnish businesses and those trading with Finnish businesses still attempt to achieve compliance with the planned regulations as soon as possible.

How to send e-invoices in Finland

The preferred way to send e-invoices to contracting public authorities in Finland is via Peppol.

Sending e-invoices via Peppol is extremely simple. Thanks to the structure of Peppol’s delivery network (known as the four corner model), all a business needs to exchange structured electronic invoices with partners is a connection to a certified Peppol access point (such as ecosio). Your provider will then be able to ensure documents are sent and received in the right format

Sending e-invoices without EDI capability

Unfortunately, without the ability to send structured electronic invoices automatically, businesses will be missing out on the many associated cost benefits of EDI. However, for those businesses unwilling to invest in securing EDI capability there are Web Portal solutions for sending e-invoices. An example for such a Web Portal is the Finnish government’s e-invoicing platform Handi.

Standards

When it comes to accepted e-invoicing standards, Finnish law currently allows businesses to trade e-invoices in whichever format they prefer (e.g. UBL or CII). However, central Finnish public bodies and those businesses looking to take advantage of the new e-invoicing legislation allowing companies to request e-invoices from partners are only able to accept the following two standards: TEAPPSXML 3.0 and Finvoice 3.0.

Both of these standards are XML-based and comply with the specifications laid out in Directive 2014/55/EU.

Finland is also currently drafting a Core Invoice Usage Specification (CIUS) in order to have a single document that companies can refer to which details all necessary requirements.

Finnish e-invoicing requirements at a glance

| STANDARDS | IS E-INVOICING MANDATORY? | CONNECTION METHODS |

|---|---|---|

|

Suppliers of central bodies:

Suppliers of non-central and private bodies:

|

Suppliers of central bodies: YesSuppliers of non-central and private bodies: Currently no, but customers will soon have the right to ask for an EN-compliant e-invoice |

|

What is the future of e-invoicing and EDI in Finland?

Although the implementation of the e-invoicing law initially proposed to come into effect on 1 April has been delayed by Covid-19, Finland’s decision to promote rejection of non-EN-compliant e-invoices is likely to have a significant impact. Not only will it encourage more B2B e-invoicing, it will also help to increase the number of businesses able to send invoices conforming to the EN standard.

Given the impressive number of Finnish businesses already utilising e-invoicing it shouldn’t be long until almost all B2B and B2G exchanges involving Finnish companies rely on structured electronic invoices. The next few years may also see Finland follow other forward-thinking countries such as Italy and Belgium, who have already begun to discuss implementing regulations relating to e-ordering.

At the very least, as more and more businesses begin to experience the benefits of automation (including public bodies), a growing number of supply chain businesses will surely seek to automate other key processes, as EDI capability becomes increasingly business-critical.

Want more information on e-invoicing in Finland?

At ecosio we have helped thousands of businesses to benefit from streamlined electronic data interchange and know exactly what efficient and reliable e-invoicing requires. For more information on e-invoicing in Finland and what steps you can take to achieve savings whilst minimising internal effort, please contact us today. We are always happy to answer your questions.

You may also be interested in our blog articles on e-invoicing in…

Are you aware of our free XML/Peppol document validator?

To help those in need of a simple and easy way to validate formats and file types, from CII (Cross-Industry Invoice) to UBL, we’ve created a free online validator.

Der Beitrag How is E-invoicing in Finland Different to Elsewhere? erschien zuerst auf ecosio.

]]>Der Beitrag The Benefits of E-invoicing – An Introduction erschien zuerst auf ecosio.

]]>On the one hand, this shift naturally means a change in invoicing processes – something that some may view with trepidation. On the other hand, however, e-invoicing brings many advantages to supply chain businesses. In this article we’ll explore these briefly in the context of the other commonly-used alternatives.

Paper invoicing

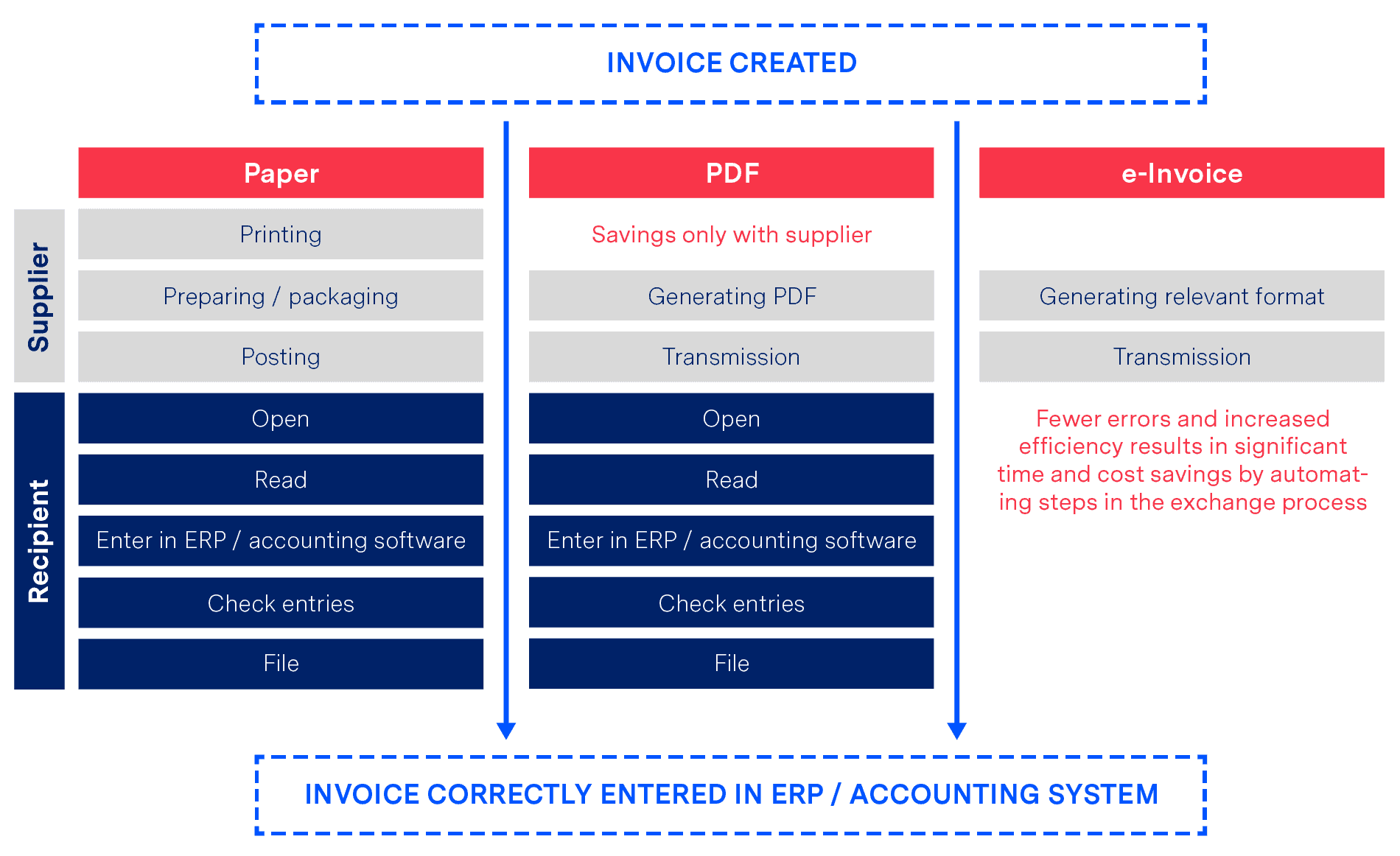

Surprisingly, paper invoices still make up a large percentage of the invoices exchanged today. Yet as the diagram below shows, this method is not only consumption heavy, it also requires significant effort compared to the alternative (e-invoicing).

The sender prints out the invoice, puts it in an envelope, stamps it and then posts it. However, the costs incurred are not limited to those relating to postage. Rather, it is the manual processes of invoice creation, which are reflected in personnel and infrastructure costs, that make the paper-based process expensive. Anyone who has ever written several invoices will be able to understand how complex and non-scalable paper-based invoicing is!

Interestingly enough, many also trust the post office “blindly” when sending invoices, simply assuming that the invoice will reach the recipient (which in most cases it does of course). However, a confirmation of receipt by the recipient is only available with the classic paper invoice for an additional charge.

PDF invoicing

Over the past decade more and more companies have moved from paper invoicing to PDF invoicing. This is due in part to the legal equivalence of the e-invoice with the paper invoice and the omission of the obligatory electronic signature. Instead of sending paper invoices, PDF documents are sent by email or offered for download. The latter option is mainly used in the B2C sector – e.g. when downloading the telecom bill.

For the sender of a PDF invoice, effort is reduced to the generation of the PDF (which is usually done automatically from the IT system) and the dispatch (which is also mostly done automatically). Admittedly this represents a significant improvement compared to paper invoicing.

However, the process is still problematic on the recipient’s side as they are still confronted with a media break, as with a paper invoice. In other words, the data cannot be transferred automatically from the PDF into the ERP/accounting system. Instead, the recipient is required to type it in manually or transfer it using copy & paste.

The reason for this is the PDF format itself. Unfortunately many people mistakenly believe PDF invoicing comes under the banner of e-invoicing. However this is not the case as a PDF is not a structured, machine-processable document format, but is instead designed to be human-readable. Formats such as XML, CSV or EDIFACT are far more suitable for automated document exchange.

E-invoicing

When an e-invoice is sent, the invoice is generated on the sender’s side in a machine-processable format (e.g. EDIFACT or XML) and then sent directly to the recipient’s IT system. There the e-invoice is absorbed by the IT system without human intervention and is immediately available for further processing (e.g. invoice verification and approval).

In contrast to paper or PDF invoices, no manual steps need to be taken and the process can be fully automated.

Furthermore, the sender (depending on the technical protocol used for invoice transmission) receives a corresponding confirmation as soon as the recipient has received the invoice.

So how do these methods compare in real terms?

The diagram below shows the steps involved in the sending and receipt of different types of invoice:

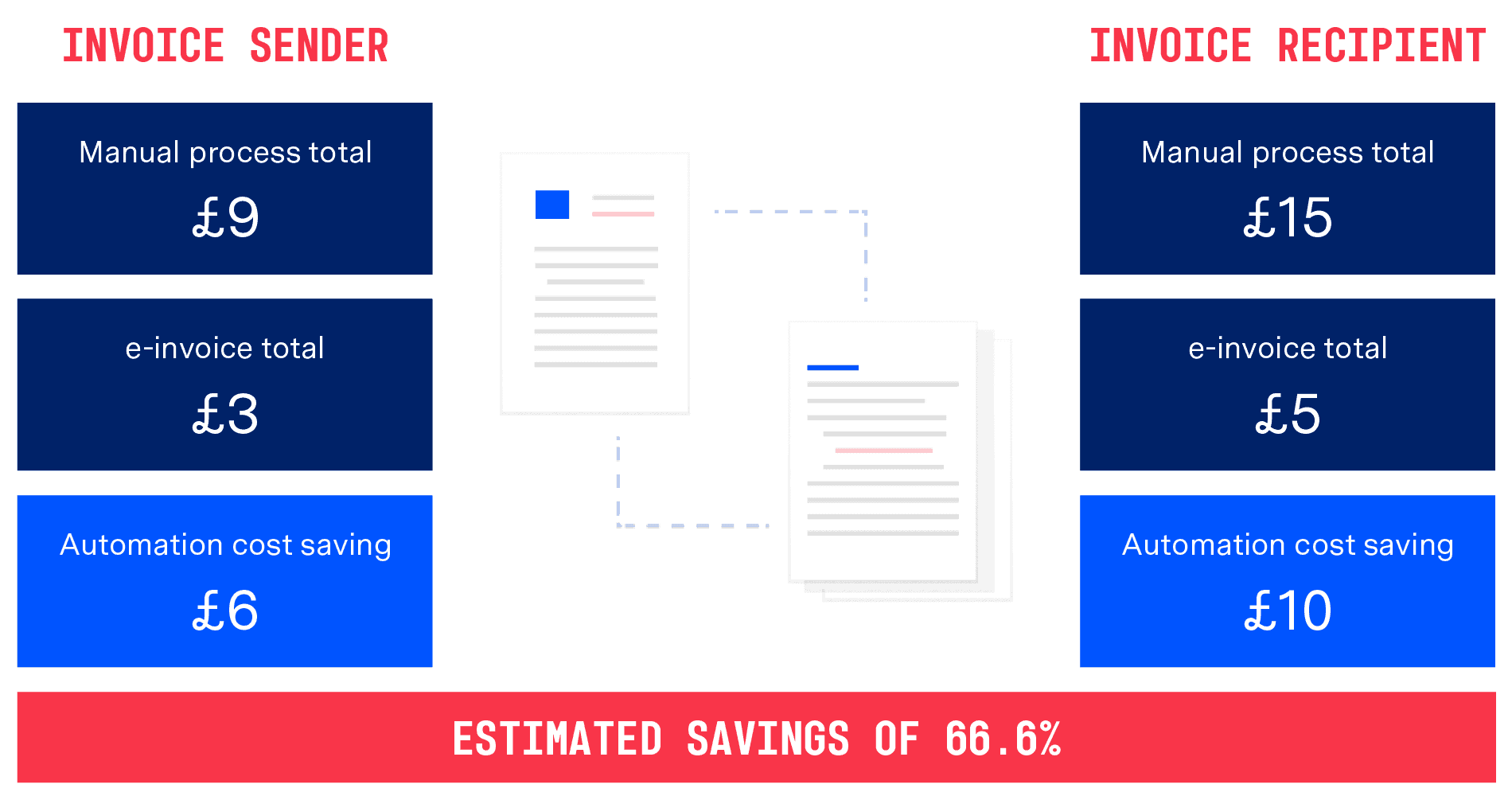

Predictably, the reduced steps also have a sizeable impact on cost. Based on numerous reports from IBM, GS1, EY and others the average cost for a company to process a single document manually is roughly around £15. These calculations consider FTE costs, opportunity costs of more value-adding activities, errors, delays and postage/fax fees (if relevant).

With an efficient EDI system in place the cost to send and receive an invoice can be reduced by two thirds!

The benefits of e-invoicing at a glance

So what are the specific benefits of using e-invoicing?

- Savings in time, shipping and personnel costs

The tedious paper-based invoicing process, from printing to postage, is completely avoided. Personnel who were previously responsible for invoicing can now be assigned to other activities. The company can concentrate on its core business again and doesn’t need to spend resources on complex support processes such as accounting. The recipient in turn is relieved from manually processing the received invoice, as the invoice data can be automatically transferred to the ERP/accounting system. - Reduced material costs

Costs for paper, printer, enveloping etc. are reduced. - Faster payment due to faster processing

The payment periods for invoices usually begin to run upon receipt of the invoice. As an electronically sent invoice is immediately available to the recipient, earlier and (hopefully) timely payments are the result. - Reduction of input errors

With the continuous automation of the invoicing process and the elimination of manual intervention, input errors are reduced to a minimum. - Simplification of archiving

According to legal regulations, companies must store invoices for future audits by the tax authorities. The length of time varies from country to country (usually between 5 and 10 years). Paper invoices are generally not well suited for long-term storage. Fire or water damage to the archive can potentially result in the loss of archived invoices. Consequences for the company in such cases can be very expensive – the tax authorities then typically start to estimate – mostly not to the advantage of the company. In the case of electronic invoice transmission, the invoice data is already available in electronic form and can therefore be very easily integrated into an electronic archiving system. With appropriate backups and data mirroring (which are standard in contemporary archiving systems), invoice data remains secure and available. - Less paper consumption

How ecosio can help

At ecosio we are experts in e-invoicing and were one of the first certified Peppol access point providers in Europe. Our team of EDI experts is well equipped to help your business benefit from automated invoicing not only with public bodies, but across your supply chain as a whole.

Uniquely, at ecosio we take care of virtually all the work necessary to allow you to trade structured electronic documents with your business partners. Unlike other so-called ‘managed’ solutions which offer customers minimal assistance when it comes to setup, testing, maintenance and error handling, ecosio offers a fully managed service, resulting in maximum efficiency with minimal internal effort. Every customer is assigned a dedicated project manager who will oversee implementation and ongoing operation of the solution, ensuring a successful outcome.

Your advantages with ecosio

- Compliance – No need to worry about e-invoicing regulations

- Cost-saving – Replace cost heavy manual processes with efficient automation

- Flexibility – Modular supply chain solutions to suit your needs

- Future-Proof – Automatic implementation of updates and renewal of certificates

- Peace of Mind – Comprehensive support and 24/7 monitoring

- Ease of Use – Direct integration in your ERP system via API

- Simplicity – One connection for all EDI partners

Find out more

To find out more about ecosio’s e-invoicing solution and how we could help you to experience the benefits of e-invoicing, get in touch today!

Chat with usDer Beitrag The Benefits of E-invoicing – An Introduction erschien zuerst auf ecosio.

]]>Der Beitrag How to Validate an XRechnung Message erschien zuerst auf ecosio.

]]>Why XRechnung?

The XRechnung is the result of the implementation of the EU Directive 2014/55/EU, which states that contracting authorities in Europe must be able to receive and process e-invoices.

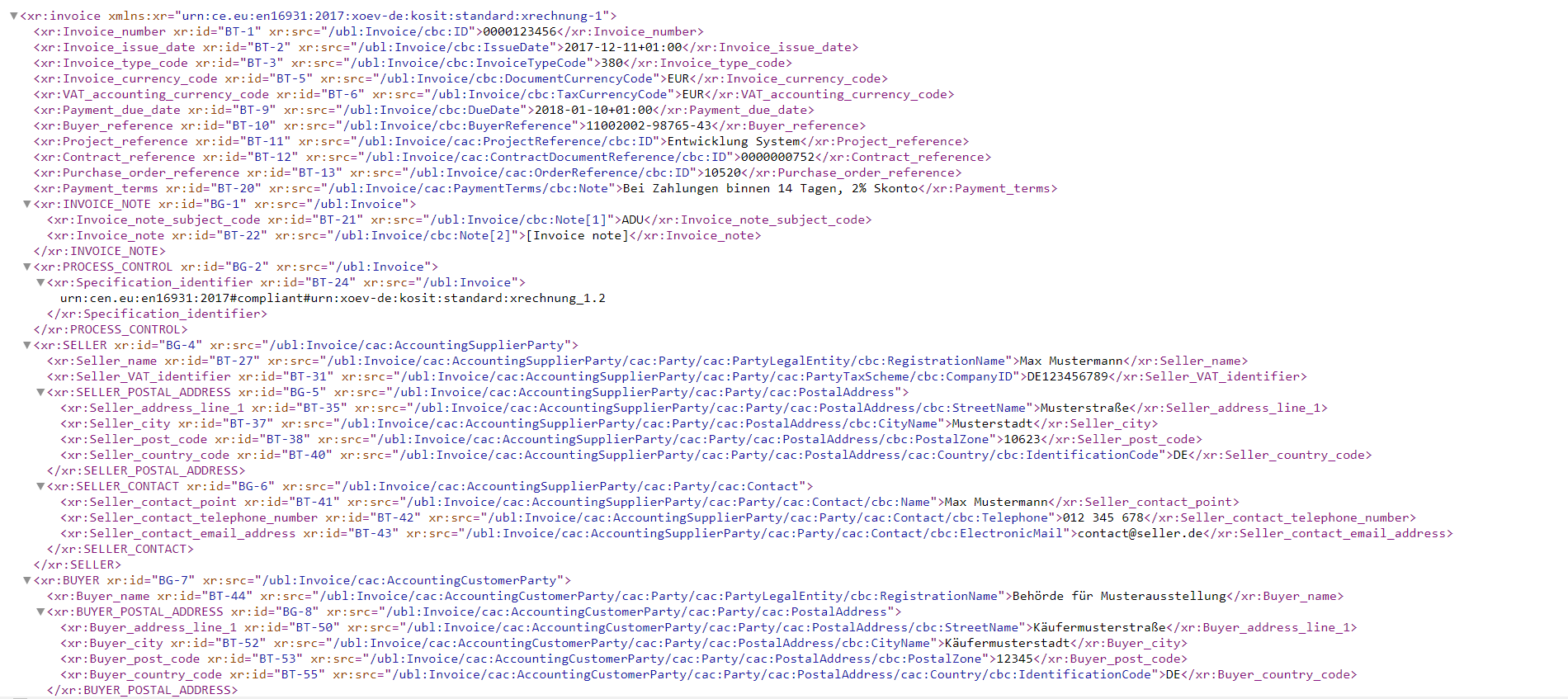

From this directive, the European Committee for Standardisation (CEN) developed EN 16931, which defines the basic components of an electronic invoice. Each member state can use this standard to create a refined guideline that addresses the specific needs of their administration. This is called Core Invoice Usage Specification (CIUS) and XRechnung is Germany’s version of this.

Did you know… ecosio offers a free tool which allows you to check your XML and Peppol messages for correctness and conformity with various formats such as XRechnung, OpenPEPPOL and more.

XRechnung: creation and transmission

For XRechnung implementation, there are two permitted syntaxes: UBL and UN/CEFACT Cross Industry Invoice (CII). This means that companies must transmit invoices in one of these two syntaxes and authorities must be able to accept and process them.

The Peppol (Pan-European Public Procurement Online) transmission protocol, which was developed to exchange data securely and reliably, is increasingly used for the mass transmission of invoices.

More details on the development, creation and transmission of XRechnung messages can be found in our article How to connect SAP to Peppol to allow the exchange of XRechnung.

Why should I validate XRechnung messages?

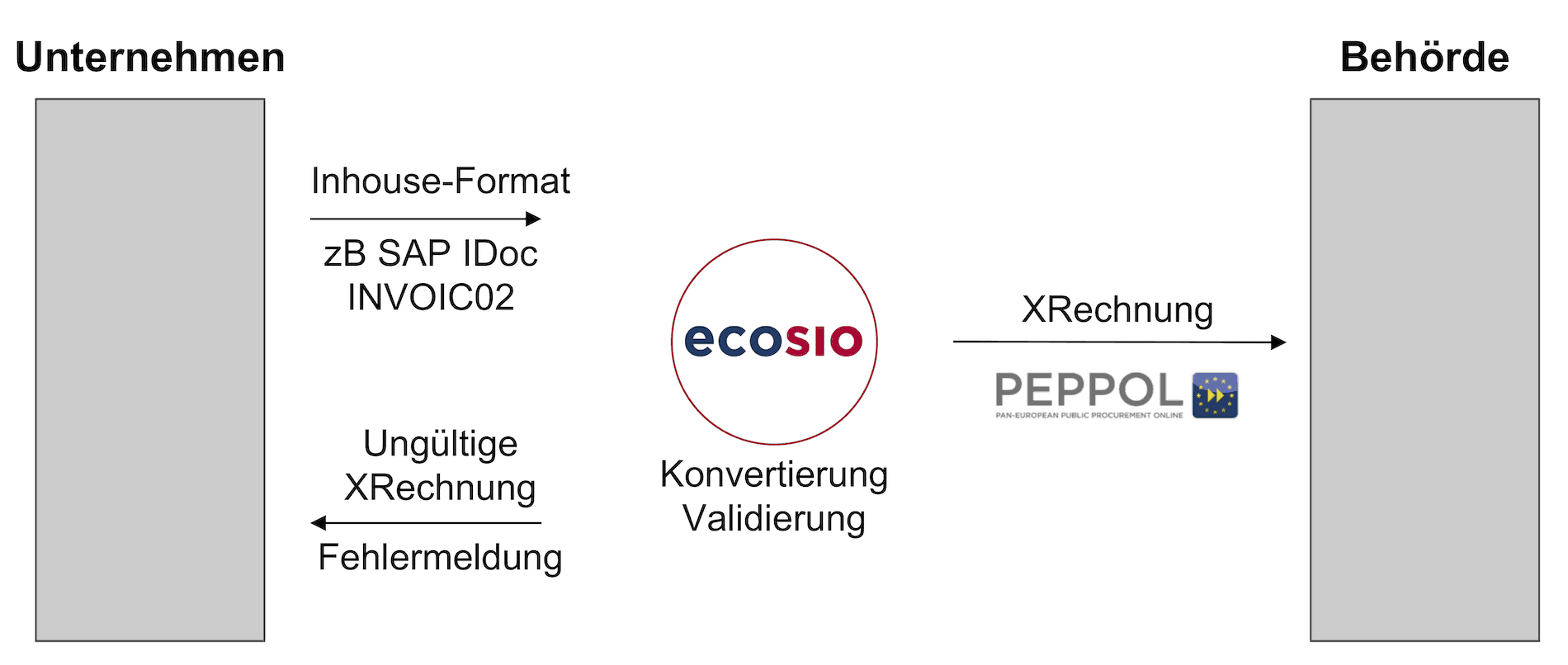

Most companies use an ERP system to map and automate processes. These systems normally export invoices in certain formats (e.g. IDoc in the case of SAP). However, this export format does not meet the requirements of XRechnung and must subsequently be converted into UBL or UN/CEFACT CII. This process is referred to as conversion, or mapping.

Section of an XRechnung in UBL (click to enlarge)

Ideally, this conversion is automated – but this alone can’t guarantee the document is correct.

There are two primary error sources:

- Mandatory fields are missing when the data is entered into the ERP system

- There is an error in the programme code during the conversion itself

By validating the document before it is transmitted, errors can be detected at an early stage. If, for example, obligatory data has not been entered, this must be communicated to the invoicing party. The biller then has the option of correcting the invoice and exporting it again.

As a general rule, invoices should only be sent if they are flawless and have been recognised as correct by a validation tool. Remember – an incorrect invoice is a reason to dispute the invoice!

How can I validate XRechnung messages?

In order to help you check that XRechnung messages are correct, we have developed a free online tool that can be used to validate a wide variety of Peppol or XML documents immediately.

Our tool can validate your XML documents according to all common specifications worldwide, from EN 16931 (e.g. XRechnung in Germany) to the A-NZ PEPPOL BIS3 for Australia and New Zealand, various UBL types, OpenPEPPOL formats, CII Cross Industry Invoice and many more – for different versions and document types.

If you would like to integrate this helpful tool directly into your own IT environment in the future, this is possible via a RESTful Web Service. For more information, please contact us.

Can I validate XRechnung automatically?

When you use an experienced e-invoicing service provider, such as ecosio, yes!

As well as handling conversion and transmission of XRechnung, a good service provider will also take care of document validation. The data exchange with the service provider works as follows…

The export file from the company’s ERP system is transmitted to the service provider, where the document is automatically converted into the XRechnung format.

Before the invoice is sent to the recipient, it is checked for accuracy, whereupon there are two possible scenarios:

- No errors occurred during validation and the creation of a valid XRechnung is thus confirmed. In this case, the invoice can be sent safely to the recipient.

- The validation was not successful and the e-invoice does not comply with the XRechnung standard. The incorrect invoice is not sent; instead a status message with a detailed error description is returned to the company’s ERP system. If, for example, data is missing, the invoicing party can then add it, export the document again and have it converted and validated by the service provider again.

Through this process, companies can ensure only invoices that comply with the standard are sent to clients. This way, companies can avoid invoice objections due to non-compliant XRechnungs.

Conclusion

Thanks to the software and tools provided by KoSIT, creating and transmitting XRechnung messages doesn’t have to be complicated. If a service provider is used, only invoices that comply with the standard will be transmitted to the authorities. Meanwhile, any errors detected are flagged in the company’s ERP system and can be corrected.

Want more information?

Still have questions about XRechnung messages or e-invoicing in general? Contact us or use our chat – we’re always happy to help!

SAP ERP® and SAP S/4HANA® are the trademarks or registered trademarks of SAP SE or its affiliates in Germany and in several other countries.

Der Beitrag How to Validate an XRechnung Message erschien zuerst auf ecosio.

]]>